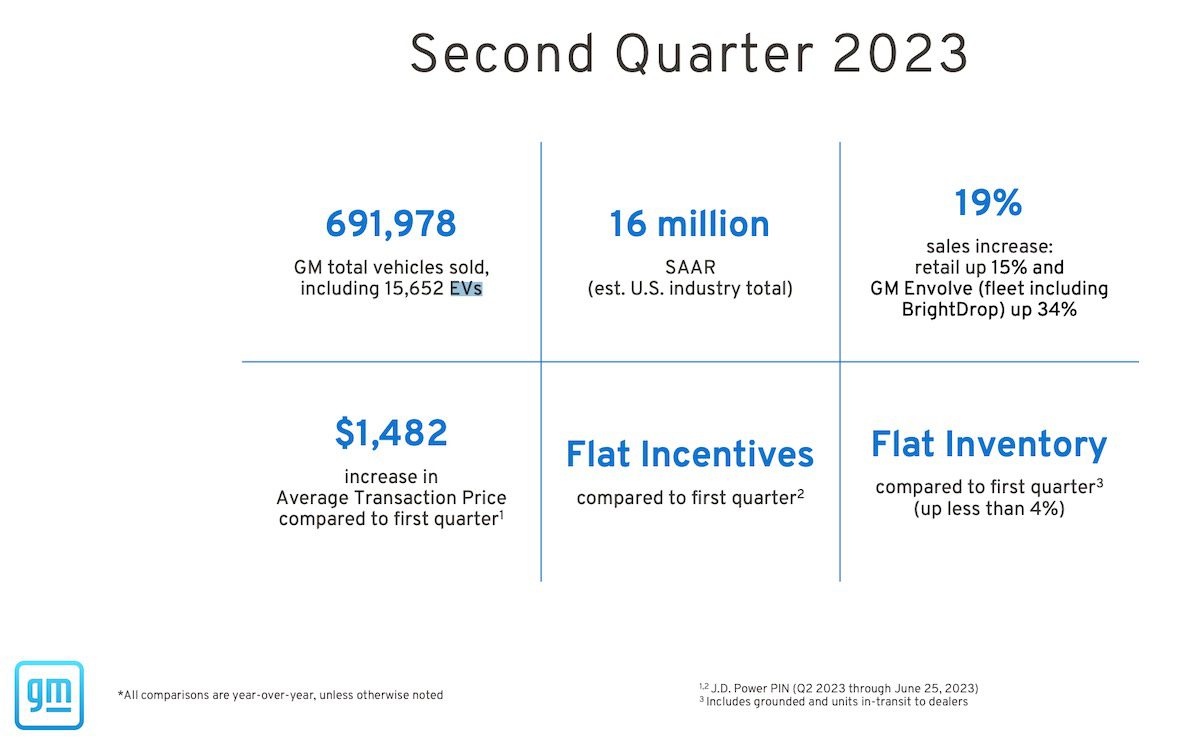

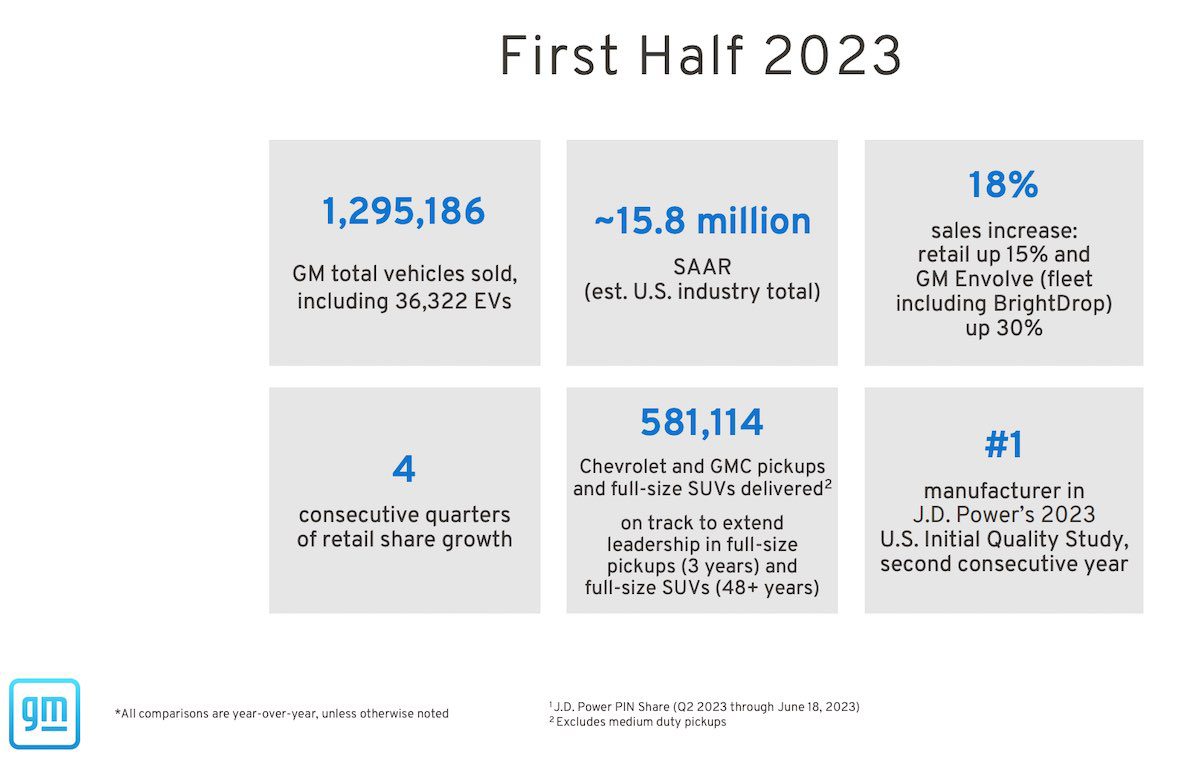

US automotive giant General Motors sold just 15,652 electric vehicles in the second quarter of 2023, down from 20,670 in Q1 representing a drop in sales of 24%.

Over the same period Tesla sold 466,140 EVs, 30 times more than GM at a 10% quarter-over-quarter growth rate. GM sold a total of 691,978 vehicles in Q2 meaning EVs made up just 2.3% of the company’s total sales, well below the US national EV market share which is now over 7%.

The Q2 numbers are a worrying sign for the US carmaker which has talked a big game on EVs but is yet to deliver in any meaningful way. With companies like Tesla and BYD on track to hit close to 2 million EVs each this year, like many other legacy auto companies, GM looks like it’s being left behind.

Here's the breakdown of the EVs GM sold in the US in Q2:

• Bolt EV/Bolt EUV: 13,959

• LYRIQ: 1,348

• Hummer EV: 47 https://t.co/0YqyxBlkBT— Sawyer Merritt (@SawyerMerritt) July 5, 2023

Big legacy auto floundering on EVs while providing vague excuses

Just this week Volkswagen also announced that it’s cutting EV production at its Emden plant in Germany despite surging June EV sales figures in Europe. The company says the production cuts are due to “strong customer reluctance” to buy their EVs.

Volkswagen attributed some of the decline in demand to reduced subsidies for EV buyers in Europe and the impact of inflation, however these factors haven’t slowed Tesla which reported record sales in the Q2.

Fellow automotive giant Toyota is also yet to gain any traction on EVs. Earlier this week details emerged from Toyota’s general meeting including discussions around an unsuccessful shareholder proposal that would require Toyota to disclose its lobbying efforts against progressive climate policies.

The response from Toyota’s accounting group chief officer Masahiro Yamamoto was vague as to why the board had recommended that shareholders vote down the proposal. Yamamoto also parroted Toyota’s long held “diversified approach” to drivetrains.

“From the outset, however, Chairman Akio Toyoda has continued to emphasize that carbon neutrality is not just about cars; we must consider the overall picture of how energy is produced, transported, and used, and that while BEVs are of course important, we must prepare a range of options,” said Yamamoto during the general meeting.

“Gradually, a growing number of people have come to embrace this mindset, and we believe that public sentiment has changed considerably.”

Top executives also fielded a question from one concerned shareholder who asked “Can Toyota beat Tesla?”

“I love BEVs. Through BEVs, I want to change the future of cars, monozukuri, and work.” came the response from executive vice president Yoichi Miyazaki while also explaining Toyota’s “multi-pathway approach” of decarbonising through diverse options.

If Toyota really does love BEVs its not showing in their numbers. Toyota sold less than 8,000 EVs in the first half of 2023 making up just 0.19% of the company’s 4.15 million vehicles sold during the period.

The excuses for disappointing EV sales are coming thick and fast from the big traditional automotive companies but the reality is they are being completely outplayed by the new entrants.

Tesla is now selling 110 electric vehicles for every one EV sold by Toyota and 30 times as many as GM.

As Tesla and BYD continue to smash EV sales records month after month, legacy auto is starting to realise that it’s staring into the abyss.

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.